Abstract

Bitcoin

is thought of as a medium of exchange, due to its layer on the internet having

an immutable blockchain ledger, cryptographic security protocol, a

predetermined supply free of centralized control, and permanence of

transaction. It also carries weight as a

form of currency, able to transact in very small increments, allowing the

cryptocurrency to be practical and ubiquitous as a global money. One issue with using Bitcoin (BTC) is the

price volatility. While BTC is valued at

$9,065 today, it has swung from a 2018 low of $3,232 to a high of $12,907 in

2019. Within the blockchain structure of

BTC lies a feature, unspent transaction output (UTXO) which acts as digital

signature from sender to receiver. This

paper will attempt to correlate historic unspent transaction outputs of BTC in

order to determine its potential for predicting BTC price volatility.

A. Bitcoin background

Bitcoin (BTC) is governed by rules which

are purely abstract and based on mathematics. These rules are oblivious to

social conventions, irrespective of their nature (Kurda, 2012). Bitcoin can

have an “enormous impact on liberating the users of Bitcoin from social norms

they disagree with” (Kurda, 2012). Some

liberal viewpoints also see BTC as means to escape from the binds of a state,

by avoiding taxation and commit money laundering. The economics of BTC and price potential is

swayed by societal norms and views of money.

As a form of money, Bitcoin can be

thought of as digital gold or gold 2.0.

It possesses several features that are perceived to carry inherent

value: immutable blockchain ledger,

cryptographic security to uphold transactions, supply which is predetermined

and degressive over time, a proof of work algorithm to very transactions and

charge fees, maintenance of ledger by network of computers, and carries

multiple inputs and outputs. It is also

divisible by up to 8 decimal places.

B. Digital signature of BTC

To track the transactions of each

Bitcoin address, Bitcoin is designed with an architecture that avoids a

potential problem in the banking industry known as double spending. This problem is solved using an accounting

structure called unspent transaction output, or UTXO. Each transaction of every block record of

state includes the input, and the output via this structure. Unspent transaction outputs are broken up so

that the correct amount, including fees, are distributed while the remaining

value of the Bitcoin is returned to the sender as change (see figure 1). Across time, it may be used as meaningful intelligence

to understanding Bitcoin pricing.

C. Choice of analytical tool

R software was chosen, due to its

bevy of statistical packages and popularity in evaluating markets within the

finance industry (data mining, technical trading, and performance analysis). R can also directly import real-time data

from stock market indices (yet such data for Bitcoin was not available). R also allows for creating easy and

customizable graphic charts and figures, including time series plots.

D. Bitcoin datasets

Using Blockchain.com (2020) data, I

gathered UTXO and USD price data for the preceding two years (March 13, 2018 to

March 4, 2020). Below is a sample of the

raw data from both Excel sheets (blockchain.com, 2020):

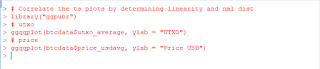

E. Analysis and visualizations

Using Excel, data was prepared by

taking weekly averages of UTXO and prices in US dollars. The data was then combined into a single

Excel sheet, and imported into R. I

performed manipulation of the factor column data into dates. Then I used R basic functions to generate time

series plots, from which R users could forecast price performance (Zhang,

2016).

As one can see, mapping both plots

of unspent transaction output (scale 40-67 million) and dollar prices of BTC

(scale $3000-$13000) was impractical to show visual correlation. Changing the y-axis scale aesthetics did not

yield adequate plots. This required knowledge

of high-level plotting techniques. I

sought to correlate the data using statistical packages built into R.

I evaluated the usefulness of the given

continuous data by testing for correlation assumptions. This is performed by visually scatter

plotting the UTXO/prices to check for linearity between them. Then, using normality plots with the ggpubr

library, I can discover whether the data falls under a normal distribution

(CRAN, 2018):

Because the UTXOs follow a sigmoid

versus a normal distribution, proper statistical methods recommend using a

non-parametric correlation—Spearman or Kendall rank-based correlation tests. Spearman’s correlation test is defined as:

rho= ∑(x′−mx′)(y′i−my′) √∑(x′−mx′)2∑(y′−my′)2

√∑(x′−mx′)2∑(y′−my′)2

Where x′=rank(x)x′=rank(x) and y′=rank(y)y′=rank(y)

The correlation coefficient between

x and y are 0.6457 and the p-value is < 2.2-16. The test indicates a moderately positive

correlation—signifying prices of BTC increases with unspent

transaction outputs of BTC.

F. Summary

The nature of Bitcoin historically shows

swings of volatility from one year to the next.

UTXOs may become a unique indicator of buy/sell pressure in the market

for Bitcoin exchanges. BTC does show price

increases that are moderately correlated to amount of BTC unspent transaction

outputs (UTXO). Indeed, the analysis

would yield more reliable results if more historical UTXO/price data were

used. With use of real-time transaction

data, the model may undergo forecasting by extrapolating days, weeks, or even

months to show asset managers and industry analysts whether to invest more or

less proportions of Bitcoin for their portfolio. BTC would not only provide an excellent

medium of exchange, but also signal measures that could properly mitigate risk

of investing in the cryptocurrency.

References

Blockchain.com. (2020).

Blockchain charts. Retrieved from

https://www.blockchain.com/charts

Surda, P. (2012 Nov 9).

Economics of bitcoin: is bitcoin an alternative to fiat currencies and

gold. Wirtschafts University. Retrieved from https://nakamotoinstitute.org/static/docs/economics-of-bitcoin.pdf

Grigg, I. (2016).

The message is the medium.

Retrieved from https://steemit.com/eos/@iang/the-message-is-the-medium

Zhang, L-C. (2016 May 13). R in finance: introduction to r and its

applications in finance. Retrieved from https://www.researchgate.net/publication/302956522_R_in_Finance_Introduction_to_R_and_Its_Applications_in_Finance

(2018). Comprehensive R archive network (CRAN). Retrieved from https://cloud.r-project.org/doc/manuals/r-release/R-intro.html#Graphics